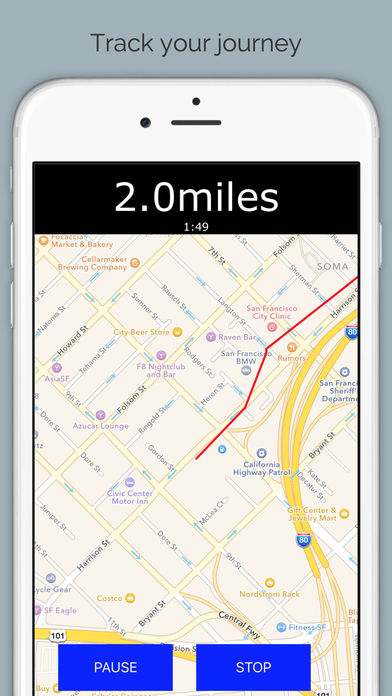

ATO Vehicle Logbook!

-

Category Travel

-

Size 2.5 MB

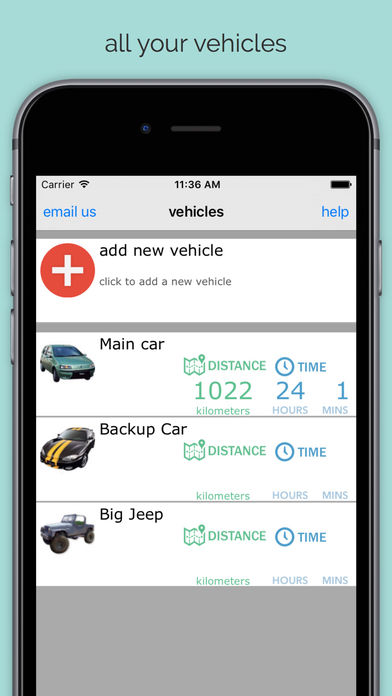

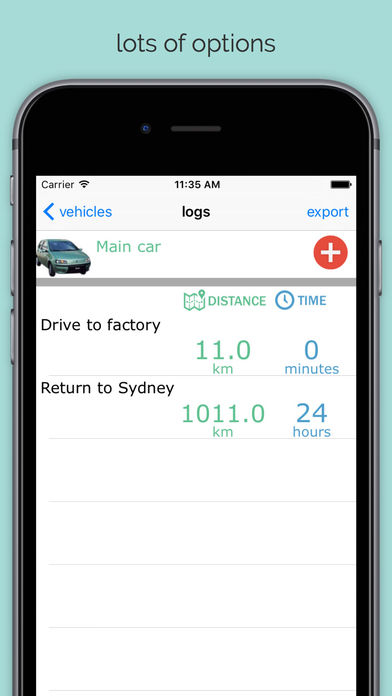

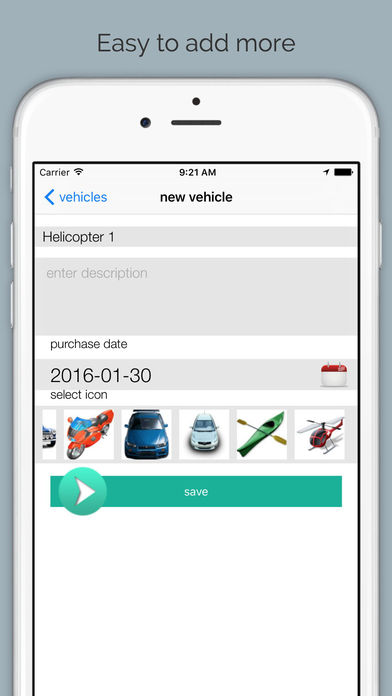

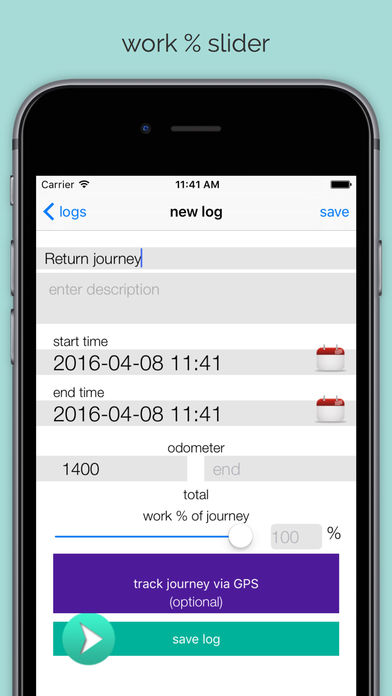

ATO Vehicle Log book is fully compliant with Australian Tax Office requirements where the logbook method is used to claim the percentage business use of a vehicle.-multiple vehicles.-choose icon to represent vehicle.-multiple logbook periods.-calculates & reports your % business use.-editing of existing trip records.-publishes CSV files.-record journey reasons and description, and optional timeSend your log directly to your employer, accountant or tax agent. You do not need to perform any additional calculations or spreadsheet manipulations. The application can also be used by employees who use their own vehicle for work related travel and need to submit KM reimbursement claims to their employers.